Conventional wisdom says all retailers lose money throughout the year until fourth quarter, when they go into the black. The biggest selling months for all items ranging from clothing to furniture are October, November and December. Is an auction house or estate sale company a retailer with the same seasonality? It’s a question that was put to three firms that are no doubt familiar to readers of Antiques and The Arts Weekly — The Benefit Shop, Elizabeth Jackson and Everything But The House.

Pam Stone is the founder of The Benefit Shop (TBS) Foundation Auction Gallery, a charitable foundation based in Mount Kisco, N.Y., that returns all profits to community nonprofit organizations.

Consignors, all too familiar with the “sales cycle” of conventional retail sales, often ask if we can hold their merchandise throughout the summer and sell in the fall. They believe that the fall will fetch higher prices when shoppers are back from vacation, when mall traffic picks up and when shops are busier with more foot traffic. Summer, in their minds, equates to slump.

But from where I sit at the TBS auction podium, there is no summer slack. We kicked off the summer with the donated and consigned contents of a Bedford, N.Y., estate that included a large number of furniture lots. The furniture was mostly traditional in style and in good condition, but at the end of the day, it was “furniture.” Other items in that sale included china, crystal, sterling, dressers, tables, chairs, carpets, lamps and clothing. What we refer to as estate contents. Was there a single hook to the auction? Was there a singularly unique piece that would be the catalog beacon? Not really. But yet, the auction enjoyed tremendous upside surprises.

The shocker of the event was a Brunschwig and Fils chinoiserie linen fabric love seat. It was estimated at $400/800, opening at $200. The computer screens and phone consoles lit up. Vigorous bidding ensued, the audience gasped and the sofa crossed the block at $14,000. A new Brunschwig and Fils record was set in the auction world and a new sofa high set at our firm.

Kristen Alexander, a dedicated member of my team, commented, “Accepting donated sofas will now be back on our internal ok-to-resell list. They were going to be in the no-fly zone along with exercise equipment and mattresses. That’s what I truly love about this business, every day is a surprise and a learning experience.”

A Brunschwig and Fils chinoiserie linen fabric love seat was estimated at $400/800 but crossed the block at $14,000. —The Benefit Shop

As we moved into July and reviewed our catalogs for sale, we again had estate merchandise from relocaters, downsizers and others donated and consigned lots from various tri-state area homes, including the former hunting lodge of the Rockefellers. The catalogs had interesting collectibles, costume jewelry, home décor items and more, but again no items that would sound the bell around the world.

But again the buyers came, the bidding was vigorous, the sales robust. An orange leather chair from Breuton New York City, estimated at $500–$1,000 was sold to an internet bidder for $2,000. A Henkel Harris china cabinet sold to a New Jersey buyer for $2,159, exceeding its $300/500 estimate.

We headed into August with a catalog of more modest inventory, and the assumption we should step away from the craps table now — so to speak— because everyone was on vacation in August, lying on the beach, reading books, swimming, fishing, golfing… but not shopping,

Our August catalog hit the internet, and ten days later the auction took place. The initial action was somewhat slow, and then we brought out the plates. Yes, just plates. They were nice plates: hand painted in Italy, pale blue with a floral design. There was a set of 12 dinner plates with a matching tureen. The estimate was $80/120. Bidding opened at a yawn… then the computer monitor volunteers could barely keep up, as prices flew in $10 increments. The audience watched as if transfixed by a tennis match, heads swiveling left to right and back again as the computer bidding progressed. They were literally gasping when the hammer dropped at $2,000.

A set of 12 dinner plates with a matching tureen, hand painted in Italy, pale blue with a floral design, estimated $80/120, drew gasps when the hammer dropped at $2,000. —The Benefit Shop

The next lot up was a set of hand painted plates from Turkey. They were colorful and decorative. The estimate was again $80/120. The auctioneer opened at $40, while a comic in the audience jumped up exclaiming, “I’ll bid $2,000!” Everyone laughed, but we all witnessed the online bidding go crazy. These decorative Turkish pottery plates crossed the block at $1,700. When the audience and TBS team learned it was a different bidder on a different internet platform than the Italian plates, it brought a standing ovation and round of applause.

Were the stars aligned and the serendipity following us? Or were we the beneficiaries of a fundamental shopping shift.

Beth Romski, another dedicated volunteer and team member, opted for some investigative work on this topic. She uncovered interesting facts that are indeed separating the auction business, the online auction business from retailers. She examined some summer statistics provided from the bidding platforms of LiveAuctioneers and Invaluable. Each experienced exponential growth in users over the summer period. She peeled back the onion to examine the additional underlying layers of growth, and additional demographics. More countries were added, breadth outside the United States was added and a broader age range of users was identified. Moreover, higher usage by the existing customer base was also identified.

While it is common knowledge that the internet transformed shopping for users and sellers alike, it has redefined the auction business. From this auction house’s perspective we are in the third inning of a game-changing cycle of growth that has legs, that is here to stay, with many more home runs to come.

For more information about The Benefit Shop, 914-864-0707 or www.thebenefitshop.org.

Elizabeth Jackson for more than 16 years has been at the helm of Elizabeth Jackson Estate Sales, a fine art and antiques business in Fairfield County, Conn. Her well-known estate sales have successfully garnered top-dollar results for hundreds of private clients, in many instances outperforming estimates from major New York auction houses, as well as achieving sales on items that, for whatever reason, had not sold at auction.

The short answer is that there is no longer any real “best season” for selling, particularly for higher-end items. Because of the broad reach of the internet, and even though my business is onsite selling from an owner’s home, marketing online is now just as — if not more — important than print advertising used to be. By advertising each sale locally and globally, we are reaching a much larger marketplace regardless of the season. Serious collectors are on the prowl year-round and reach out to buy remotely.

In the past, there were seasons that I tried to avoid conducting sales because of presumed low traffic — on or near national holidays, January/February and the height of summer. In recent years, however, we achieved record prices for art and antiques at sales that took place in the middle of raging snowstorms, hurricane aftermaths and steamy July heat waves — typically “poor turnout” times of the year.

That said, I do close down my own business during August, because I find that my Fairfield and Westchester County buyers are away and distracted by family vacations. Low foot traffic has more of an effect on the ability to sell items of lower value; the more unusual or rare pieces will find their audience regardless of time of year with effective marketing. In the estate sale business, if you have a very large collection of household goods to liquidate, fall and spring are both generally good timing — but, onsite sales are influenced by real estate closing dates and that can happen anytime. So, as some sales in recent years show, I don’t worry about timing anymore.

During Christmas week, for example, a pair of Dutch Old Master paintings sold for $25,000; a Tiffany table lamp fetched $24,000 and a pair of Nineteenth Century American portraits by Erastus Fields went out at $25,000.

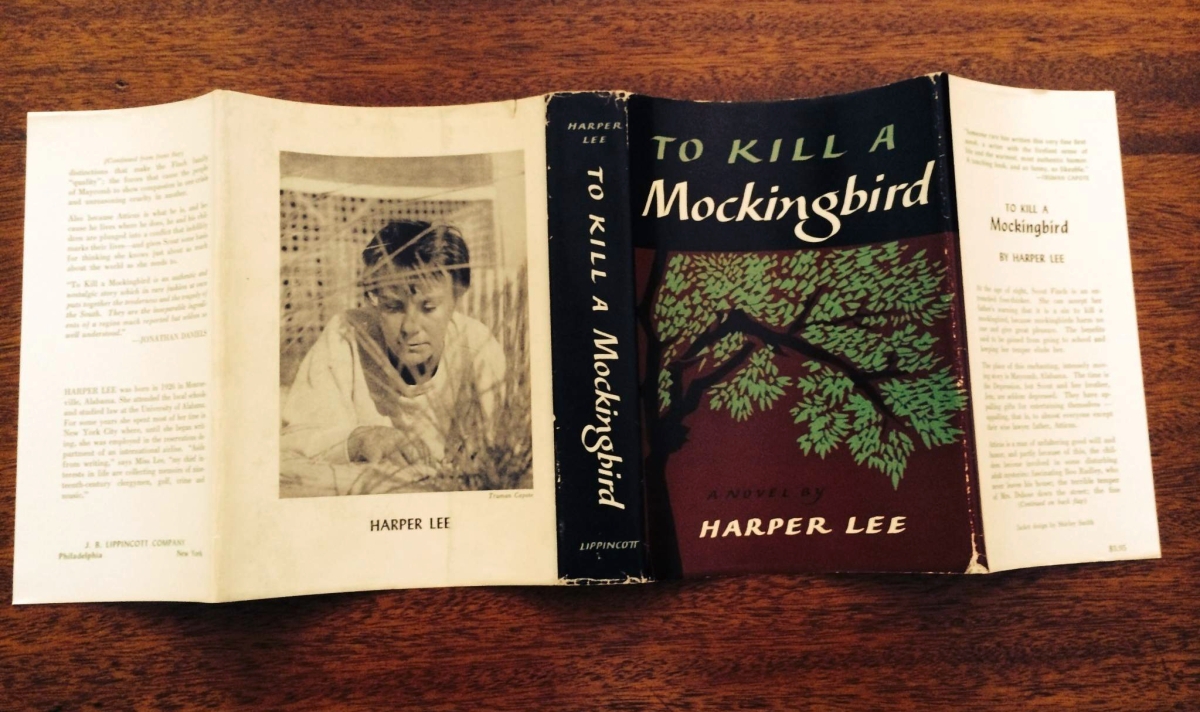

The January and February snowstorms did not keep a Hudson River painting by Jervis McEntee from achieving $100,000, a Steinway piano from selling at $26,000, a photo portfolio from changing hands at $15,000, a Warhol print from hitting $7,000, and a first edition of To Kill a Mockingbird from bringing $8,000.

And in mid-July, a pair of Giacometti lamps sold for $20,000, while a 1904 Tiger rug made $5,000 and an antique Heriz carpet with damage found a new home for $10,500.

For further information about Elizabeth Jackson Estate Sales, www.elizabethjackson.com or 203-857-4009.

Brian Graves is the co-founder of the online estate sale marketplace known as Everything But The House (EBTH), headquartered in Cincinnati, Ohio, and expanded into 27 cities across the United States. The firm’s business model is simple but compelling. Individuals and families contact EBTH about selling a collection, whether it is rare coins or a lifetime of household objects. Consultations are free.

The company’s trained staff sorts, catalogs, photographs and writes descriptions for each item, then uploads them to EBTH.com. If there are pieces not fit for sale, EBTH helps arrange for donation and/or trash removal. The sale goes live and items are up for auction for seven days, with all bids starting at $1. After fast and furious bidding, the sale closes and EBTH manages payment, pickup and shipping and delivery.

In my experience, the impact of seasonality on an estate sale depends on the type of audience that participates in the venue and the type of venue itself. In more traditional auction formats that rely heavily upon established, local audiences that must physically attend the sale, controlling audience attendance is paramount and the key to any successful event. In these cases, you must compete with busy bidder schedules, the weather and other regional sales venues, along with numerous other limiting factors to have the audience required to drive success. This makes it necessary to control as many of the unknowns as possible, including seasonality impacts, when utilizing these types of platforms.

Of course, that being said, you can’t always control when or where items need to be sold based on the client’s immediate needs. For this reason, we set out to establish a platform that made these uncontrollable factors irrelevant. Increasing the audience size by leveraging an expanded platform, such as the internet, which increases the potential for participation from audiences outside of the region will certainly minimize this impact. One of the founding principles of EBTH.com involved increasing audience participation by offering newly discovered collections to a global audience of participants, in an approachable format for an extended window of time. This strategy has been key to our ability to minimize the impact of variations seen both in collecting interests and seasonal buying habits.

In today’s marketplace, however, it’s no longer sufficient to just offer items online with hopes of maximizing the potential for a seller. It’s now necessary to create platforms that are commonplace in a user’s daily activities, which become more of a pastime, that leverage both content and unique collections to promote participation. The size of the audience, the marketing prowess of the firm, and the ability to maintain the engagement of consumers all have a significant impact. Even after EBTH.com surpassed 100,000 registered bidders and one million site visits per month in 2015, we still noted a statistical relevance to the impact of the summer months on bidder activity.

Of course, this was much less volatile and controllable compared to venues that only offer access to a regional audience. However, it still had a marginal impact on the outcome of a sale, so when we had the opportunity to influence the outcome by controlling the sale timing, we continued to do so.

With our continued growth in 2016, now that we’ve exceeded 650,000 registered users and benefit from more than three million site visits per month, this volatility has substantially decreased. In fact, during the summer of 2016, we saw an 8 percent increase in the average number of bidders and a 17 percent increase in the average number of visitors per sale, with July posting the most substantial gains. In short, much like any type of economy, the more you diversify your portfolio and your audience, the less of a reduction you will see in the bottom line of your investment, independent of uncontrollable factors.

Some recent sale highlights include a late Qing dynasty court robe with dragons that sold for $17,400; a 14K electroplated gold on brass and mosaic lapis lazuli table that was bid to $8,880; a Kate Moss acrylic portrait titled Sister Kate with Chanel Rosary that made $8,400; a Henry Lawrence Faulkner original oil on board depicting a still life that brought $12,299; and a Chinese ink and acrylic original painting, 1973-77 by Fong Chung Ray that finished at $16,200.

For information about Everything But The House, www.ebth.com or 888-862-8750.